Author: Guy Shepherd

In the last few months, a number of existing clients and start-up insurers have approached us with a view to developing game-changing bulk annuity offerings.

While each proposition has its own distinctive unique selling points, the one thing that they all have in common is using technology being able to provide more flexible, informed and responsive calculation of price or value of the scheme benefits.

Based on our recent discussions, there appear to be three primary challenges:

- ability to cope with wildly different formats, structures, quality and completeness of source datasets

- developing calculations that can consume the various scheme datasets and handle a huge variety of scheme benefits, even across different populations of the same scheme; defined benefit features, such as contracting out are of particular interest

- ability to calculate a price quickly across the entire scheme while goal seeking one or more key parameters – such as investment returns or profit margins

Responding to the challenge

It has been great to showcase just how well the Mo.net platform can cope with the specific challenges of bulk annuity modelling to existing and potential customers alike.

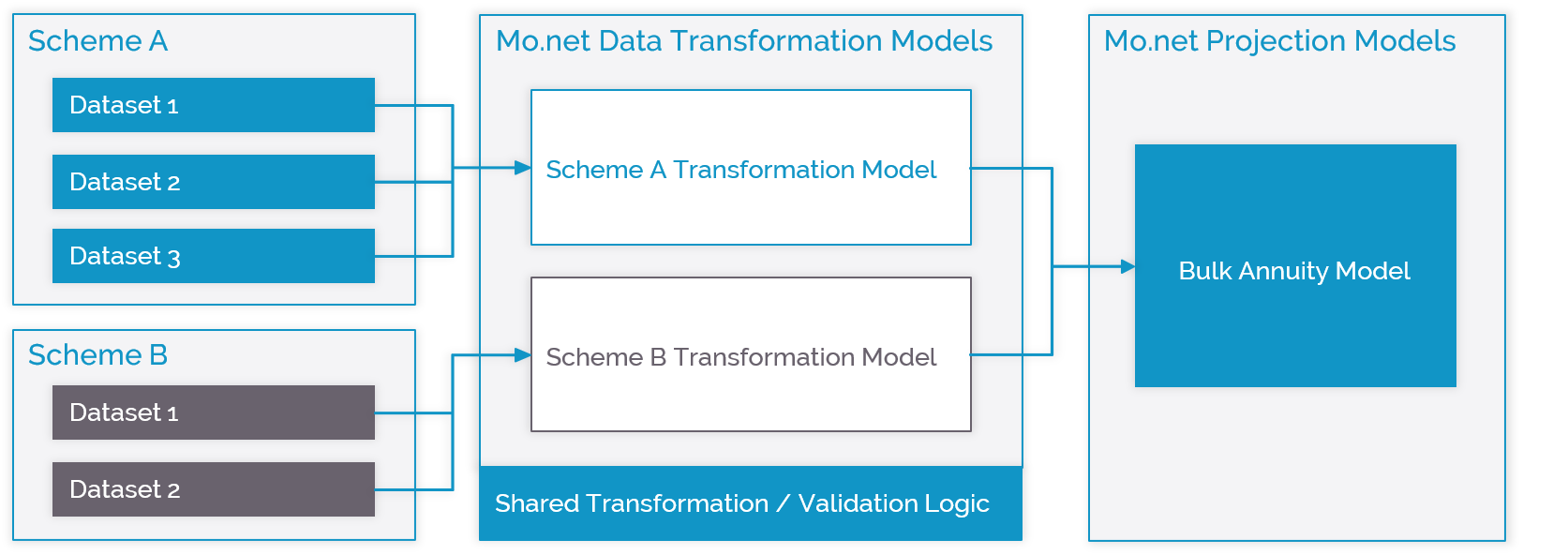

Based on these discussions, it sounds like the most impressive & useful feature is the ability to construct a single comprehensive bulk annuity model that can cope with all the vagaries of defined benefit schemes, but apply that single model to scheme datasets with wildly different structures, formats and quality.

Furthermore, the ability to model scheme benefits dynamically – i.e. construct a model that copes with a variable number of benefit structures is seen as a really significant benefit for clients.

Please get in touch if you’re interested in seeing for yourself how Mo.net copes with the challenges of bulk annuity pricing and quotations.

Comments are closed.